The Only Guide to How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Things about Obtaining Copy Of Bankruptcy Discharge Papers

Table of ContentsThe 3-Minute Rule for Chapter 13 Discharge PapersOur How To Get Copy Of Bankruptcy Discharge Papers IdeasThe Greatest Guide To Copy Of Chapter 7 Discharge PapersThe Copy Of Chapter 7 Discharge Papers PDFsHow To Obtain Bankruptcy Discharge Letter Things To Know Before You Get ThisThe Ultimate Guide To How To Obtain Bankruptcy Discharge Letter

A discharge is a court order which specifies that you do not have to pay many of your financial obligations. You can not discharge financial debts for a lot of taxes; youngster support; spousal support; a lot of student finances; court fines and criminal restitution; and individual injury created by driving intoxicated or under the impact of drugs.

You can just obtain a chapter 7 discharge once every 8 years. Various other rules might use if you formerly got a discharge in a chapter 13 case. No person can make you pay a debt that has been discharged, however you can willingly pay any kind of debt you want to pay.

Top Guidelines Of How To Get Copy Of Chapter 13 Discharge Papers

Some financial institutions hold a safeguarded insurance claim (for example, the bank that holds the home mortgage on your home or the lender that has a lien on your automobile). You do not have to pay a secured claim if the financial obligation is discharged, but the creditor can still take the property.

If you are a specific and also you are not represented by an attorney, the court should hold a hearing to decide whether to approve the reaffirmation contract. The agreement will not be lawfully binding up until the court authorizes it. If you reaffirm a financial obligation and afterwards fall short to pay it, you owe the financial debt the like though there was no personal bankruptcy - https://b4nkrvptcydcp.shutterfly.com/.

The Facts About How To Obtain Bankruptcy Discharge Letter Uncovered

The creditor can additionally take lawsuit to recuperate a judgment versus you - https://site-8095858-2862-9054.mystrikingly.com/blog/little-known-questions-about-bankruptcy-discharge-paperwork. Changed 10/05.

To request court records online, please full the kind listed below (http://ideate.xsead.cmu.edu/discussion/urban-intervention-spring-2015/topics/copy-of-bankruptcy-discharge-papers). If you are asking for to review court documents at the courthouse, you will certainly be spoken to when the situation documents is offered to review. If you are asking for to purchase duplicates of court records, you will certainly be contacted with price and a distribution time price quote.

Do NOT send your social security number, financial institution or debt card info via this website. The staff can not ensure the security of info or records sent via this portal. Additionally, any type of document, records, or records sent out to the clerk using this website may be disclosed in conformity with Florida's Public Records Law.

The Main Principles Of Bankruptcy Discharge Paperwork

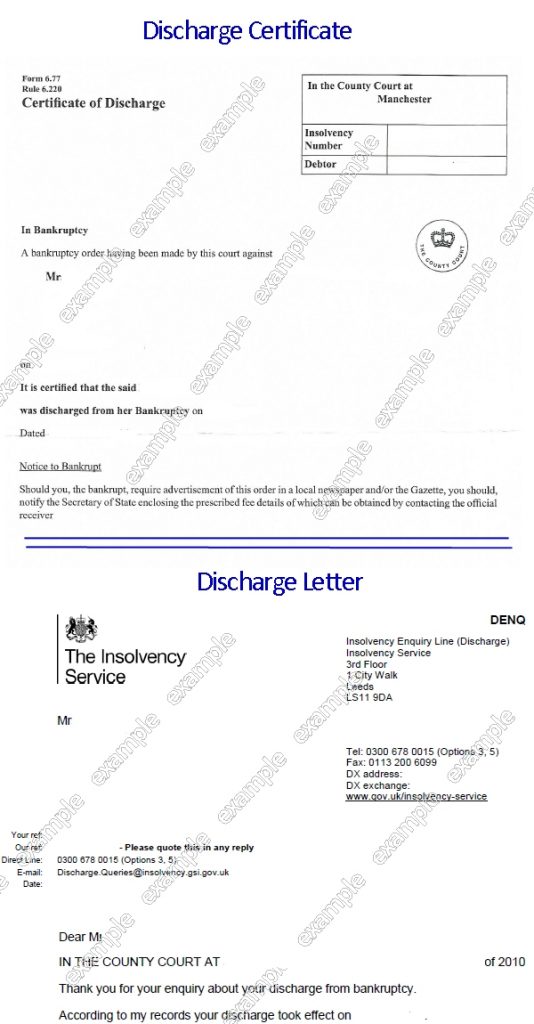

A Chapter 13 personal bankruptcy discharge is a very powerful thing. It stops your lenders from pursuing discharged financial obligations completely. But it can likewise be confusing. how to obtain bankruptcy discharge letter. Let's address some of the typical concerns about the Phase 13 discharge. A "discharge" is the elegant legal term for your financial debts being forgiven in your personal bankruptcy.

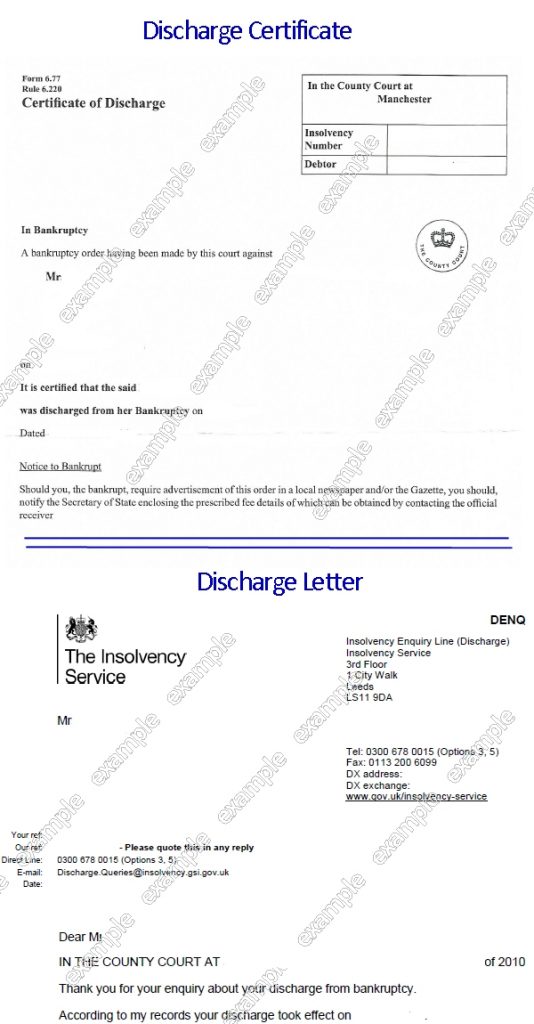

The Chapter 13 "discharge order" is the last order you get in your Chapter 13 bankruptcy. It is authorized by the personal bankruptcy court appointed to your situations as well as states plainly that you have actually obtained a Chapter 13 discharge. To put it simply, it is the formal paper that launches you of your financial obligations.

We ought to note that there are 2 kinds of discharge under Phase 13. The very first is the common discharge approved upon completion of plan settlements. This is called an Area 1328(a) discharge. The 2nd is called a "challenge discharge" and also is in some cases called a Section 1328(b) discharge. The difficulty discharge is far much less typical.

The 9-Minute Rule for How Do I Get A Copy Of Bankruptcy Discharge Papers

While every court is somewhat different, the Chapter 13 discharge order looks similar. It is signed by a judge as well as states that "A discharge under 11 U.S.C. 1328(a) is approved to: Your Call". When you get your discharge, your creditors are "enjoined" from pursuing the debt. That implies that the court has ordered them to stop collection task.

We normally see this in instances where debt collection companies proceed to send payment needs even though the person obtained the discharge. One of the biggest things concerning personal bankruptcy is that your financial debt is released tax complimentary - how to obtain bankruptcy discharge letter.

You would certainly need to pay tax obligation on any type of cash forgiven by the debt collector. In insolvency, the discharge makes it to make sure that the debt forgiveness is not taxable. This occurs. It's an accounting problem obtaining copy of bankruptcy discharge papers for the financial institution. No worries. You can just finish an IRS Kind 982 when you complete your tax obligation returns to describe you have a bankruptcy discharge.

8 Easy Facts About Bankruptcy Discharge Paperwork Shown

If we file your tax obligations for you, we will do this for you so you don't need to worry concerning it. We talk about the timeline in the Phase 13 bankruptcy process, yet typically, you will certainly receive the discharge order regarding 1-3 months after finishing your Chapter 13 plan settlements. The length of your Chapter 13 strategy varies from instance to case.

A lot of debts are dischargeable in Chapter 13 with a couple of exemptions. Far extra financial obligations are dischargeable in Phase 13 than in Phase 7.